Pat deposits 600 in a savings account – Pat’s decision to deposit $600 into a savings account marks a significant step toward financial security. This action not only secures the funds but also opens up avenues for growth and future financial stability. In this comprehensive analysis, we delve into the implications of Pat’s deposit, exploring its impact on their financial situation, comparing it to alternative savings options, and outlining strategies to maximize savings while mitigating potential risks.

Overview of Pat’s Savings Account Deposit

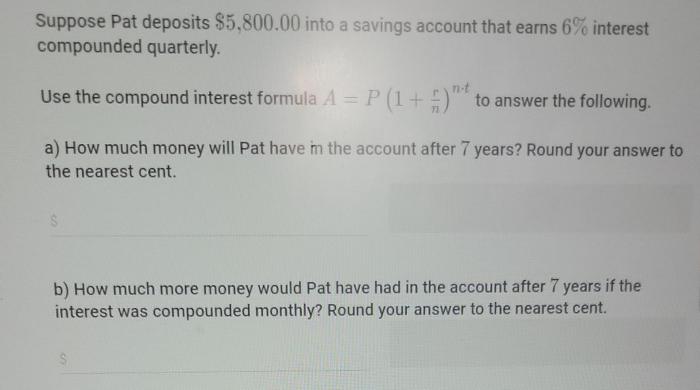

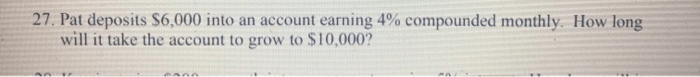

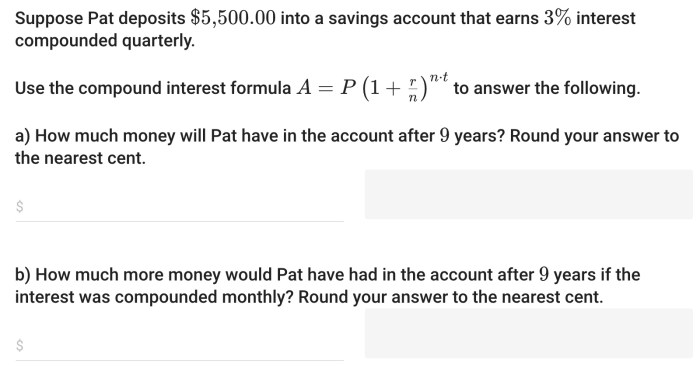

Pat has deposited $600 into a savings account. This deposit may have been made for various reasons, such as saving for a future purchase, an emergency fund, or to accumulate funds for a financial goal.

Impact on Pat’s Financial Situation

This deposit can positively impact Pat’s financial situation by providing a financial cushion and encouraging responsible financial habits. A savings account offers a safe and accessible way to store funds, earning interest over time.

Benefits of a Savings Account

- Provides a safe and secure place to store money.

- Earns interest, allowing funds to grow over time.

- Helps build an emergency fund for unexpected expenses.

Comparison to Other Savings Options

| Feature | Savings Account | Money Market Account | Certificate of Deposit (CD) |

|---|---|---|---|

| Interest Rate | Low to moderate | Higher than savings accounts | Highest of the three options |

| Fees | May have low monthly fees | May have higher fees | May have early withdrawal penalties |

| Accessibility | Easy access to funds | Limited access to funds | Funds are locked for a specific term |

Strategies for Maximizing Savings: Pat Deposits 600 In A Savings Account

Pat can maximize their savings by implementing the following strategies:

- Set financial goals and create a budget.

- Reduce expenses by identifying and cutting unnecessary spending.

- Increase income through additional work or investments.

- Invest wisely by diversifying their portfolio and considering higher-yield savings options.

Potential Risks and Considerations

Saving money comes with potential risks and considerations:

Inflation, Pat deposits 600 in a savings account

Inflation can erode the purchasing power of savings over time.

Market Fluctuations

Savings invested in the stock market or other investments are subject to market fluctuations and potential losses.

FAQs

What are the benefits of having a savings account?

Savings accounts offer several benefits, including earning interest on deposited funds, providing a safe and accessible place to store money, and encouraging regular savings habits.

How can I maximize the growth of my savings?

To maximize savings growth, consider setting financial goals, creating a budget, reducing expenses, increasing income, and investing wisely.

What are the potential risks associated with saving money?

Potential risks include inflation eroding the value of savings, market fluctuations affecting investments, and the need to maintain discipline in saving habits.