Jane has just recorded customer payments against open invoices, marking a significant step in the financial reconciliation process. This crucial task ensures the accuracy of accounting records, streamlines cash flow management, and minimizes errors. Understanding the methods, challenges, and best practices involved in this process is essential for businesses seeking to optimize their financial operations.

Customer Payment and Invoice Reconciliation

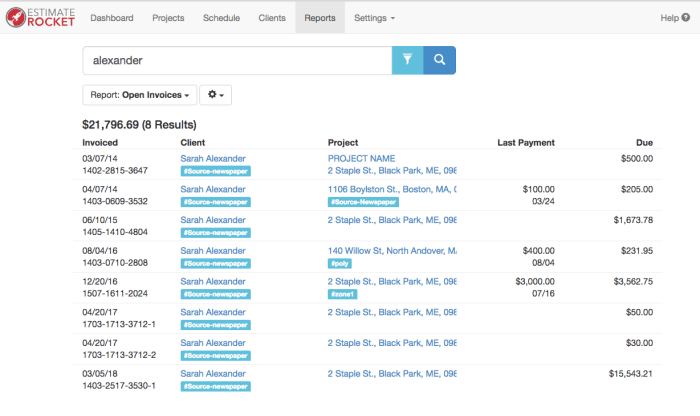

Customer payment and invoice reconciliation is a crucial accounting process that ensures the accurate matching of payments received from customers to their corresponding open invoices. This process involves comparing the details of each payment, such as the amount, date, and reference number, with the details of the outstanding invoices to verify that the payment has been correctly applied.

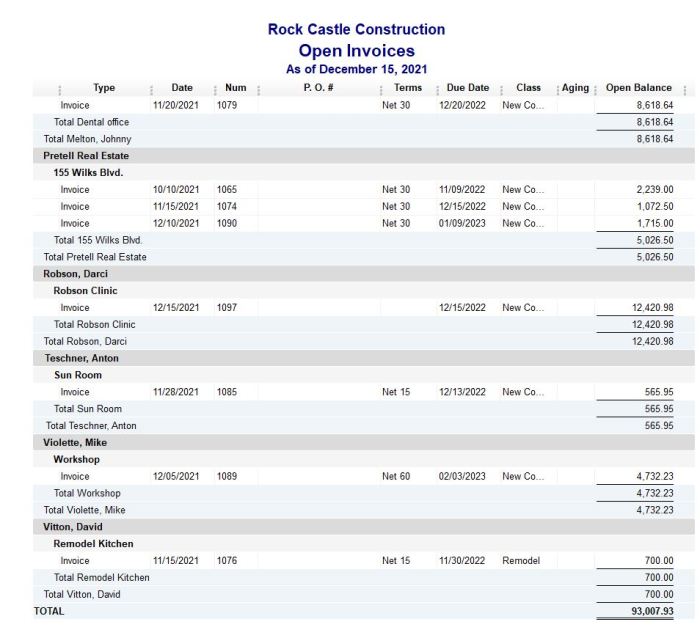

Accurate reconciliation is essential for maintaining proper accounting records, ensuring that the business has a clear understanding of its financial position and accounts receivable status. It helps prevent errors, such as overpayments or underpayments, and ensures that all payments are accounted for and allocated to the correct invoices.

Incorrect reconciliation can lead to several consequences, including:

- Inaccurate financial reporting, which can affect the business’s credibility and decision-making

- Cash flow issues due to incorrect tracking of payments and outstanding invoices

- Increased risk of fraud or errors, as incorrect reconciliation can provide opportunities for unauthorized transactions or discrepancies

Methods for Recording Customer Payments

There are several methods used to record customer payments against open invoices:

Manual Reconciliation

In manual reconciliation, payments are matched to invoices manually, often using spreadsheets or paper records. This method is time-consuming and prone to errors, especially when dealing with a large volume of transactions.

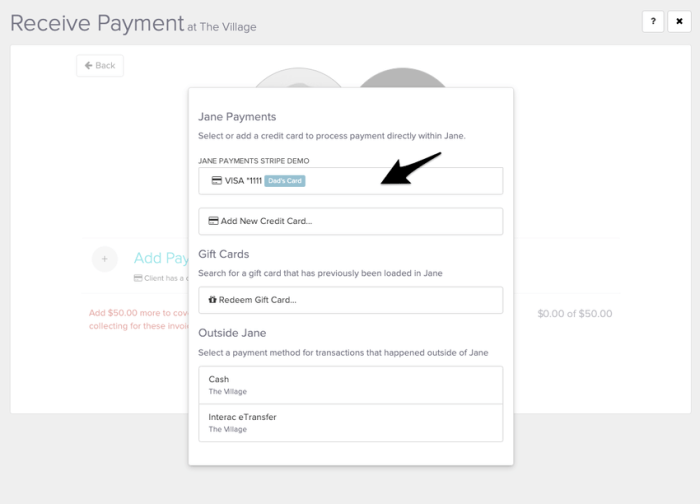

Automated Reconciliation, Jane has just recorded customer payments against open invoices

Automated reconciliation involves using software or systems that automate the matching process. These systems can import payment data from various sources, such as bank statements or payment gateways, and match them to open invoices based on predefined rules and algorithms.

Automated reconciliation is more efficient and accurate than manual methods, reducing the risk of errors and saving time.

Jane’s Role in the Reconciliation Process

Jane’s responsibilities in the customer payment and invoice reconciliation process include:

- Matching payments to open invoices and verifying the accuracy of the matching

- Investigating and resolving any discrepancies or errors in the reconciliation process

- Maintaining records of payments and reconciled invoices for audit purposes

- Communicating with customers to resolve any payment issues or discrepancies

Jane’s actions directly impact the accuracy and efficiency of the reconciliation process. By following best practices, such as thorough verification, timely investigation of discrepancies, and clear communication, she can ensure the integrity of the accounting records and contribute to the smooth operation of the business.

Challenges and Solutions in Payment Reconciliation: Jane Has Just Recorded Customer Payments Against Open Invoices

Common challenges in payment reconciliation include:

- High volume of transactions, which can make manual reconciliation time-consuming and error-prone

- Data entry errors, which can lead to incorrect matching of payments to invoices

- Incomplete or missing information, such as missing reference numbers or incorrect invoice details

Solutions to address these challenges include:

- Implementing automated reconciliation systems to reduce the workload and improve accuracy

- Establishing clear guidelines and procedures for data entry and reconciliation to minimize errors

- Regularly reviewing and updating reconciliation processes to identify and address any inefficiencies or issues

Impact of Reconciliation on Business Operations

Accurate and timely reconciliation can positively impact business operations in several ways:

- Improved cash flow management: Accurate reconciliation ensures that all payments are accounted for and allocated correctly, providing a clear picture of the business’s cash position.

- Reduced errors: Automated reconciliation systems and clear procedures minimize the risk of errors, leading to more accurate financial reporting and decision-making.

- Enhanced financial reporting: Accurate reconciliation supports the preparation of reliable financial statements, which are essential for external reporting, investor confidence, and regulatory compliance.

Businesses that prioritize effective reconciliation practices experience improved financial control, increased efficiency, and enhanced decision-making capabilities.

FAQ

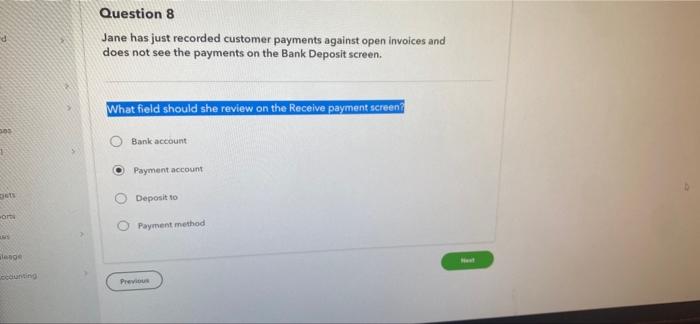

What is the significance of reconciling customer payments against open invoices?

Reconciliation ensures the accuracy of accounting records, prevents errors, and facilitates proper cash flow management.

What are the common methods used to record customer payments?

Manual and automated reconciliation processes are commonly used, each with its own advantages and disadvantages.

What is Jane’s specific role in the reconciliation process?

Jane is responsible for matching customer payments to open invoices, ensuring accuracy and efficiency.