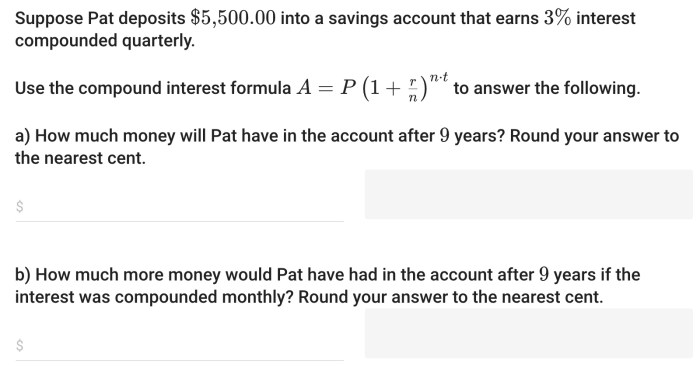

What is the difference between routine bills and predictable goals? This question delves into the intricacies of personal finance, where managing both types of financial obligations is crucial for financial stability. Routine bills, such as rent or utilities, are regular expenses that occur at fixed intervals, while predictable goals are specific financial targets that individuals set for themselves, such as saving for a down payment on a house or retirement.

Understanding the differences between these two types of financial commitments is essential for effective budgeting and financial planning. By distinguishing between routine bills and predictable goals, individuals can prioritize their financial obligations, allocate their resources wisely, and achieve their long-term financial objectives.

Routine Bills and Predictable Goals

Routine bills and predictable goals are two important aspects of financial planning. Routine bills are expenses that occur on a regular basis, while predictable goals are those that you can plan for in advance.

Routine Bills

Routine bills are expenses that you can expect to pay on a regular basis. These bills include things like rent or mortgage payments, car payments, insurance premiums, and utilities. Routine bills are typically due on a monthly or quarterly basis.

Predictable Goals

Predictable goals are those that you can plan for in advance. These goals include things like saving for a down payment on a house, paying off debt, or retiring. Predictable goals can be short-term (less than a year), medium-term (1-5 years), or long-term (5+ years).

Differences between Routine Bills and Predictable Goals, What is the difference between routine bills and predictable goals

| Routine Bills | Predictable Goals | |

|---|---|---|

| Definition | Expenses that occur on a regular basis | Goals that you can plan for in advance |

| Frequency | Monthly or quarterly | Varies depending on the goal |

| Timeframe | Ongoing | Short-term, medium-term, or long-term |

| Examples | Rent, mortgage, car payments, insurance premiums, utilities | Saving for a down payment on a house, paying off debt, retiring |

Managing Routine Bills and Predictable Goals

Managing routine bills and predictable goals is an important part of financial planning. Here are some tips for managing routine bills:

- Create a budget and track your expenses.

- Automate your bill payments.

- Negotiate lower interest rates on your debts.

- Cut back on unnecessary expenses.

Here are some tips for achieving predictable goals:

- Set realistic goals.

- Create a plan to achieve your goals.

- Track your progress and make adjustments as needed.

- Stay motivated and don’t give up.

By following these tips, you can effectively manage routine bills and predictable goals and achieve your financial goals.

Frequently Asked Questions: What Is The Difference Between Routine Bills And Predictable Goals

What are the key differences between routine bills and predictable goals?

Routine bills are regular expenses that occur at fixed intervals, while predictable goals are specific financial targets that individuals set for themselves.

How can I effectively manage both routine bills and predictable goals?

Effective management involves creating a budget that allocates funds for both types of financial commitments, prioritizing expenses, and seeking professional advice if needed.

What are some tips for achieving predictable goals?

Setting realistic goals, creating a plan, and regularly monitoring progress are key strategies for achieving predictable goals.